Pocket Option Halal: A Comprehensive Guide for Traders

Pocket Option has gained popularity among traders for its user-friendly interface and diverse trading options. However, for Muslim traders, the question remains: Is Pocket Option Halal? This article delves into the Islamic finance principles that determine whether trading on Pocket Option aligns with Halal standards. You can learn more about the Halal options available by visiting Pocket Option Halal https://p0cketopti0n.com/pocket-option-halal/, where we explore the intricacies of Halal trading on this platform.

Understanding Halal Trading

In Islamic finance, the term «Halal» refers to actions that are permitted under Islamic law (Sharia). This includes ethical guidelines covering various aspects of life, including finance and trading. Islamic finance prohibits activities involving certain practices, such as:

- Riba: Interest or usury, which is strictly forbidden.

- Gharar: Excessive uncertainty or ambiguity in contracts.

- Investments in Haram: Activities involving alcohol, gambling, pork, and other prohibited sectors.

For trading platforms to be considered Halal, they must adhere to these principles. This evaluation is crucial for Muslim traders who wish to ensure their financial dealings do not conflict with their religious beliefs.

Pocket Option Overview

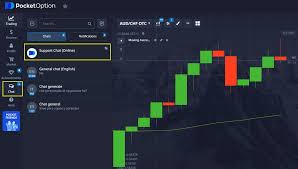

Pocket Option is a binary options trading platform that allows users to trade various financial assets, including currencies, cryptocurrencies, commodities, and stocks. The platform is noted for its ease of use and accessibility, making it popular among novice and experienced traders alike.

Does Pocket Option Align with Halal Standards?

When considering whether Pocket Option is Halal, several factors must be examined:

1. Trading Products

Pocket Option offers a wide range of trading products. As a trader, it’s essential to ensure that the assets you are trading do not belong to sectors that are considered Haram. For example, trading assets related to alcohol or gambling would not be permissible.

2. No Riba Involved

One of the central principles of Islamic finance is the prohibition of Riba (interest). Pocket Option operates as a binary options platform, and users are not charged interest on their trades. As such, there is no element of Riba, which is a positive aspect for Muslim traders.

3. Absence of Gharar

Gharar refers to excessive uncertainty in a contract. Trading binary options involves a fixed risk and reward scenario, which can reduce uncertainty. However, the binary options trading format itself may still be viewed as speculative. Traders should assess their risk tolerance and understanding before proceeding.

Trading Ethically on Pocket Option

For traders wishing to maintain an ethical approach in their trading practices, it’s essential to follow specific guidelines, such as:

- Research Assets: Ensure the assets you trade are in accordance with Islamic principles.

- Avoid Speculation: Try to base your trading decisions on research and analysis rather than speculation.

- Set Limits: Establish trading limits to avoid impulsive trading behavior, which can lead to unnecessary risk.

Conclusion

Pocket Option can offer a viable trading platform for Muslim traders, provided they ensure their activities comply with Halal guidelines. By understanding the nature of the assets they trade, monitoring their transactions to avoid interest (Riba), and minimizing uncertainty (Gharar), traders can participate in the financial markets without conflicting with their religious beliefs. As always, it’s advisable to seek guidance from knowledgeable sources in Islamic finance to make well-informed decisions.

In summary, the pursuit of Halal trading on Pocket Option is not only possible but can also be fulfilling. By adhering to Islamic principles, traders can successfully navigate the world of trading while maintaining their faith and values.